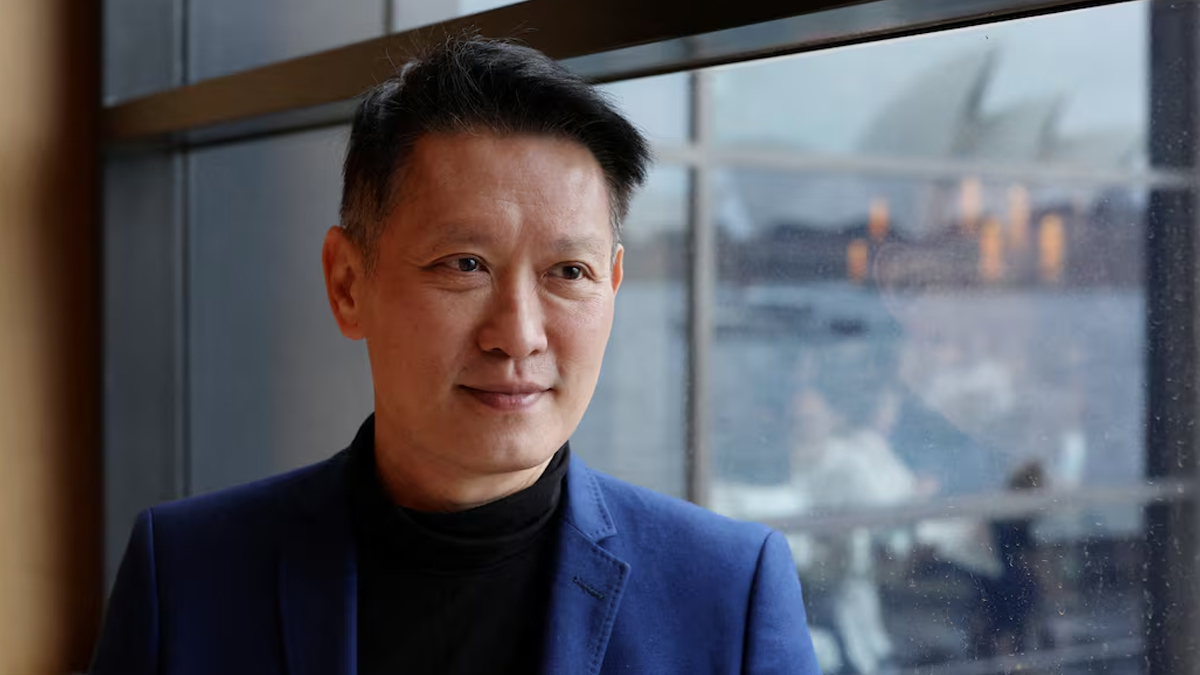

The CEO of Binance, one of the world’s largest cryptocurrency exchanges, stated that Bitcoin’s recent high volatility remains in line with broader global markets, rather than being driven by crypto-specific events. This assessment follows a sharp downturn in the price of Bitcoin (BTC), which dropped approximately 21% in November and over 23% in the last three months. The CEO attributed a significant portion of this decline to widespread investor deleveraging and a general risk-off sentiment impacting traditional assets globally.

This market commentary is significant because it reinforces the growing consensus that crypto is increasingly behaving like a risk-asset class rather than a standalone category or a traditional “hedge” against economic instability. As expectations for rate cuts by central banks like the US Federal Reserve have receded, the higher opportunity cost of holding non-yielding, volatile assets like BTC has triggered selling pressure that mirrors movements in the equity and tech markets.

The CEO’s statement seeks to manage investor expectations by decoupling the BTC price movement from internal crypto-specific events (such as regulatory crackdowns or internal exchange failures). This framing supports the narrative that Bitcoin is maturing into a highly correlated macro-asset, positioning it firmly within the complex web of global financial systems.