SEC vs. Ripple: A Legal Battle Comes to an End

After nearly four years of courtroom disputes, the long-standing SEC vs. Ripple case has officially come to a close. On August 22, the Second U.S. Court of Appeals approved a settlement between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs, marking the end of a lawsuit that began in 2020. Both parties filed a joint appeal earlier this month, effectively withdrawing from further legal challenges.

The original lawsuit was filed in December 2020, when the SEC accused Ripple of conducting an unregistered securities offering through its sales of XRP tokens. In July 2023, Judge Analisa Torres ruled that while XRP trading on exchanges does not violate securities laws, direct sales of the token to institutional investors did breach securities regulations. Ripple was fined $125 million, a fraction of the $2 billion originally sought by regulators.

A Turning Point Under New U.S. Leadership

The case took a new turn after Donald Trump’s re-election and subsequent changes in SEC leadership. Both sides moved towards a resolution, although Judge Torres rejected Ripple’s request to remove penalties on institutional sales. Her earlier ruling, which classified XRP traded on exchanges as not a security, is now final and cannot be appealed. Going forward, institutional XRP sales will require SEC registration, but retail trading remains unaffected.

Ripple ETF Speculation Gains Momentum

With the legal uncertainty cleared, attention has quickly shifted to the possibility of XRP-based exchange-traded funds (ETFs). Major asset managers including Grayscale, Bitwise, Franklin Templeton, 21Shares, WisdomTree, and CoinShares have all updated their filings with the SEC for spot XRP ETFs.

Bloomberg ETF analyst James Seyffart described the wave of applications as “expected but encouraging,” noting that SEC feedback has likely shaped these revised submissions. Similarly, Nate Geraci, president of NovaDius Wealth, highlighted the significance of multiple firms adjusting their filings simultaneously.

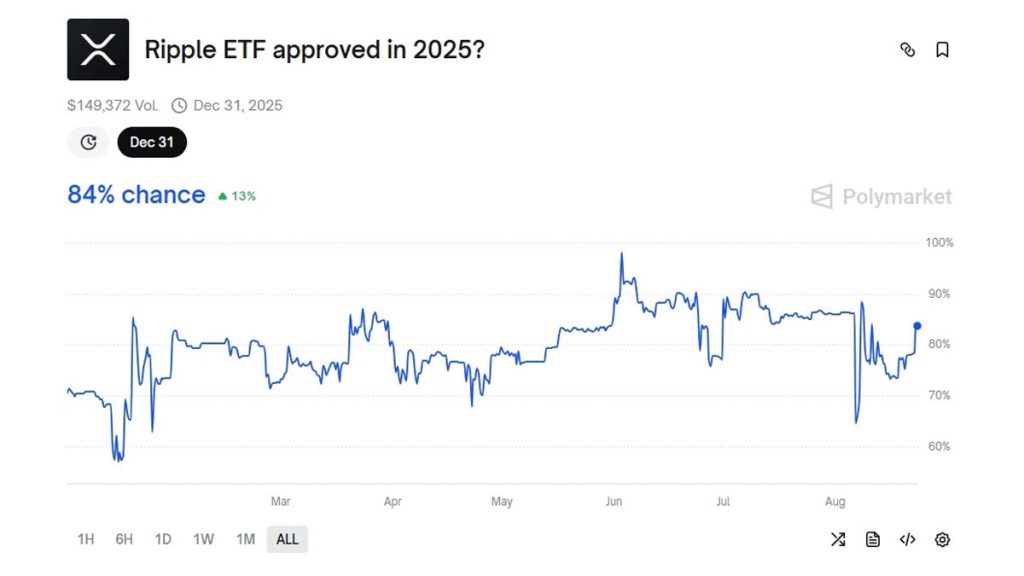

Prediction markets are also signaling optimism. On Polymarket, the probability of XRP ETF approval in 2025 recently surged to 84%, rebounding from a low of 65% earlier this summer. Bloomberg’s analyst team maintains confidence in a 95% likelihood of SEC approval, projecting a potential green light as soon as October.

XRP Price Reaction and Market Outlook

Following the court’s decision and renewed ETF speculation, XRP prices climbed nearly 7% in 24 hours, supported by a broader crypto market rally. The surge was further fueled by comments from Federal Reserve Chairman Jerome Powell, who suggested a possible interest rate cut in September during his speech at the Jackson Hole conference. XRP is currently holding above $3, reinforcing investor sentiment that the token has entered a new bullish phase.

Conclusion

The closure of the SEC vs. Ripple case marks a pivotal moment not only for Ripple but also for the wider crypto industry. With XRP no longer classified as a security on exchanges, institutional pathways now depend on proper registration, while retail markets continue trading freely. The prospect of an XRP ETF approval could bring mainstream adoption closer than ever, making 2025 a potentially transformative year for Ripple and its investors.