Two of the most prestigious U.S. universities — Harvard and Brown — have recently reported significant increases in their Bitcoin holdings via spot Exchange-Traded Funds (ETFs), signaling growing institutional interest in the cryptocurrency market.

Harvard’s $116 Million Bitcoin Bet

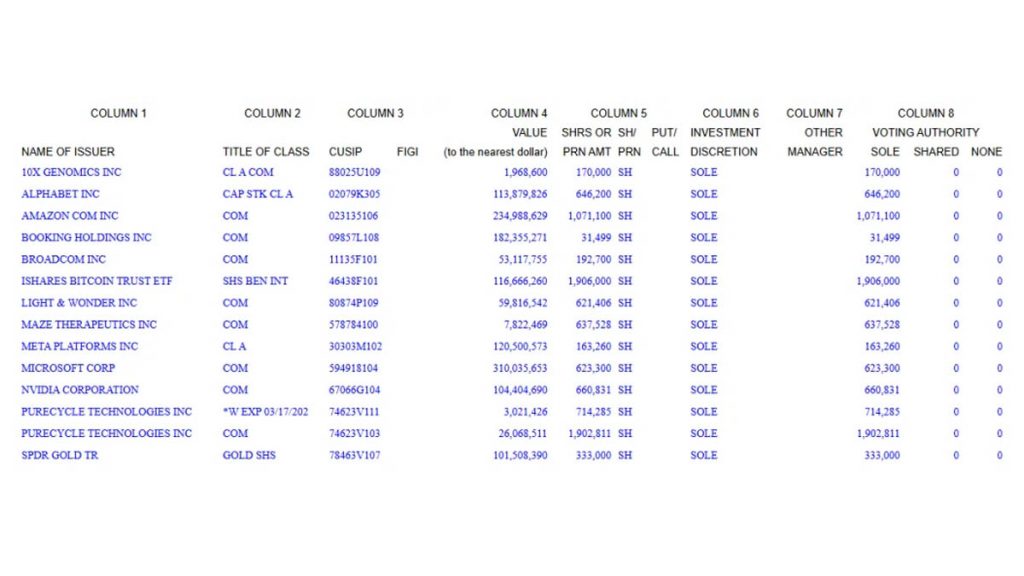

In a recent SEC filing, Harvard Management Company, which oversees the university’s endowment, disclosed the purchase of $116 million worth of shares in the BlackRock spot Bitcoin ETF (IBIT).

By July 30, Harvard held approximately 1.9 million IBIT shares, placing the cryptocurrency investment alongside — and in some cases ahead of — other major holdings such as Nvidia ($104 million), Meta ($120 million), Amazon ($234 million), and Microsoft ($310 million).

This acquisition has made Harvard the 29th largest IBIT shareholder among over 1,300 investors, further solidifying the presence of Bitcoin in elite institutional portfolios.

Brown University Doubles Its Bitcoin Exposure

Brown University also reported owning 212,500 IBIT shares, valued at around $13 million at the time of filing. This marks a twofold increase from the 105,000 shares it held at the end of March.

Bloomberg ETF analyst Eric Balchunas commented that while these investments are substantial for ETFs, they remain relatively small within the context of Harvard’s massive endowment. He also noted that U.S. endowments have historically been cautious about ETFs, often favoring more traditional investment strategies inspired by the Yale model.

Market Context: Bitcoin ETFs on the Rise

On August 8, the U.S. spot Bitcoin ETF market recorded its third consecutive day of inflows, totaling $403 million — with nearly $360 million of that attributed to IBIT. Over the past trading week, the net inflow reached $246 million.

Since the start of the year, corporate treasuries and funds have collectively purchased 371,111 BTC, which is 3.75 times greater than the total mined by Bitcoin miners over the same period. This trend underscores the accelerating adoption of Bitcoin as a store of value among large institutions.

Conclusion

While Harvard and Brown’s Bitcoin ETF positions may represent only a fraction of their total portfolios, their involvement signals a notable shift in institutional sentiment toward cryptocurrency. As Bitcoin ETFs continue to see substantial inflows, more universities and large endowments could follow suit — further integrating digital assets into the traditional financial ecosystem.